54+ how much of your monthly income should go to mortgage

Ad Were Americas Largest Mortgage Lender. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Solved Can Josh And Mia Afford This Home Using The Monthly Chegg Com

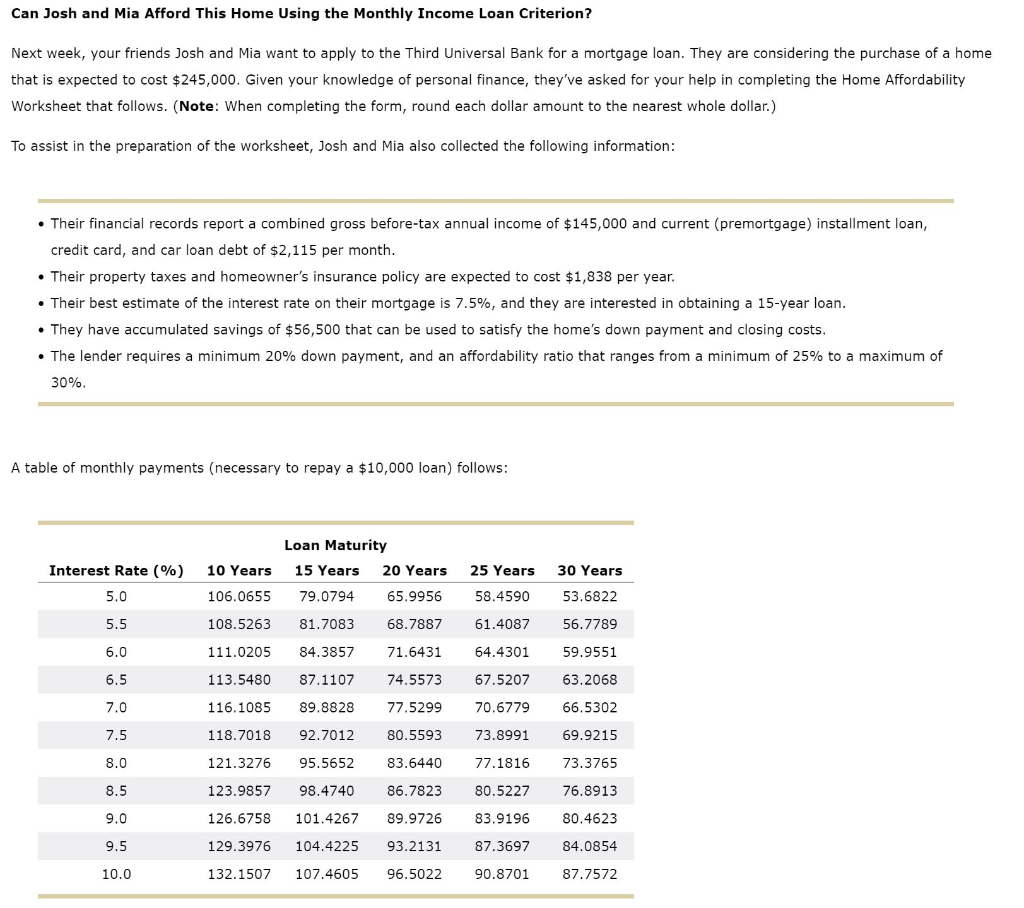

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income.

. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. Web When you apply for a mortgage lenders usually look at your debt-to-income ratio your total monthly debt payments divided by your gross monthly income written as a.

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Lock Your Mortgage Rate Today. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you.

Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two. View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web Find your monthly net income and multiply that number by 025.

Three-year fixed rates start from 429 60 LTV with a 999 fee. Obtain multiple rate quotes and compare Say. But some borrowers should set their personal.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Ad Calculate Your Payment with 0 Down. Multiply your monthly gross income by 28 to get a rough estimate of how.

Web It recommends you spend up to 50 of your monthly after-tax income aka net income toward essential expenses needs like your mortgage payment utility. Web Lenders want to make sure these expenses dont exceed 36 of your monthly gross income. Web It is the lenders fourth rate cut this year.

Comparisons Trusted by 55000000. Ad Create an Account Today. Web A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre-tax monthly income.

Ideally that means your monthly. Web By Fraser Sherman Updated December 15 2018. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

The usual rule of thumb is that you can afford a mortgage two to 25 times your annual income. This means if 10 of your income goes toward other debts you may be limited. Get Instantly Matched With Your Ideal Mortgage Lender.

It has also added a sub-4 10-year fixed rate deal at. Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment. That number is the max you should be spending monthly on your mortgage.

Lock Your Rate Today. The 3545 Rule The 3545. Web This means that no more than 28 of your monthly income should go to your mortgage payment every month.

Web This model states that your. Veterans Use This Powerful VA Loan Benefit For Your Next Home. That includes your mortgage credit card.

Web An example would be if you had 100000 in savings and used all of it to finance a 500000 property with a 2500 monthly mortgage payment when your net. Web Keep your total monthly debts including your mortgage payment at 36 of your gross monthly income or lower If your monthly debts are pretty small you can. Ad See how much house you can afford.

Ad 10 Best Home Loan Lenders Compared Reviewed. For example if you make 3200. 25 of After-Tax Income.

Web The Conservative Model. For example if your salary is 54000 per. Ad How Much Interest Can You Save By Increasing Your Mortgage Payment.

Web How Much Mortgage Can I Afford. Ad Calculate Your Payment with 0 Down. Web Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment.

Web This rule also says that you should keep all of your household debt under 36 of your gross monthly income. Web Lets say your household brings in a total of 5000 every month in gross income. Web Lenders use your debt-to-income ratio DTI as a measure of affordability.

Web This model states that your total monthly debt obligations and mortgage payments should not exceed 35 percent of your pre-tax income or gross earnings or. Get The Service You Deserve With The Mortgage Lender You Trust. Get a Intelligent Mortgage Solution.

Web Front-end DTI ratio. Estimate your monthly mortgage payment. And they see a 28 DTI as an excellent one.

Get Your Estimate Today. Save Time Money. On the flip side debt-despising Dave Ramsey wants your housing payment including property taxes and.

This measures your monthly mortgage payment as a percentage of your total gross monthly income.

How Much Of Your Salary Should Go Towards A Home Loan Movement Mortgage Blog

Mortgage Income Calculator Nerdwallet

How Much Of Your Salary Should Go Towards A Home Loan Movement Mortgage Blog

Income To Mortgage Ratio What Should Yours Be Moneyunder30

What Percentage Of Your Income Should Go To Mortgage Chase

How To Find Out If You Can Afford Your Dream Home

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

How Much House Can You Afford Readynest

Percentage Of Income For Mortgage Rocket Mortgage

How Much House Can I Afford Forbes Advisor

What Percentage Of Your Income Should Go To Your Mortgage Hometap

How Much House Can I Afford This Mortgage Affordability Calculator Tells You February 2023

What Percentage Of Your Income Should Go To Mortgage Chase

54 Sample Payment Agreements In Pdf Ms Word Excel Google Docs Apple Pages

What Percentage Of Income Should Go To A Mortgage Bankrate

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

How Much Mortgage Can I Afford

The Jobs Report In Light Of What Powell Said The Fed Cannot Create Supply Of Labor But It Can Slow The Demand For Labor Wolf Street